Real estate investment: our rule #1

- Posted by admin

At Florida Invest, our priority is to provide our investors with investors with performance opportunities based on rational criteria such as such as quality of cash flow. Therefore, our priority (regardless of the investment vehicle) is to deliver a maximum degree of stability in terms of cash flow. cash flows. A counter speculative approach approach, based on rational indicators such as rental demand in the area, the segment, demographic growth, market vacancy rates, and average growth market vacancy rates, and average rent growth. This is what we This is what we call "smart investing".

For each investment format, we scrupulously respect our specifications in order to ensure the maximum security for our investors, while deeply analyzing the areas of our market in order to detect the best opportunities.

These rules represent our investment fundamentals, which combine macro and microeconomic, demographic, technical, financial and real estate expertise.

Rule #1: the property must meet the local demand

In the U.S., the working middle class is the majority population segment: they drive cities by working, consuming and entertaining around the areas in which they live. These middle classes also save the least and inject the most money into the real economy. Their main problem is to find housing near the business centers where they work, in pleasant areas and with the infrastructure they need (schools, entertainment, hospitals, transportation, etc.), in line with their income.

The vast majority of this middle class is renting, as these households do not qualify for a home loan. Providing affordable housing near the activity centers of major American cities is therefore one of the main challenges for American cities in the 21st century. This is particularly true in Southeast Florida, where the region's attractiveness and economic dynamism have led to an explosion in population growth.

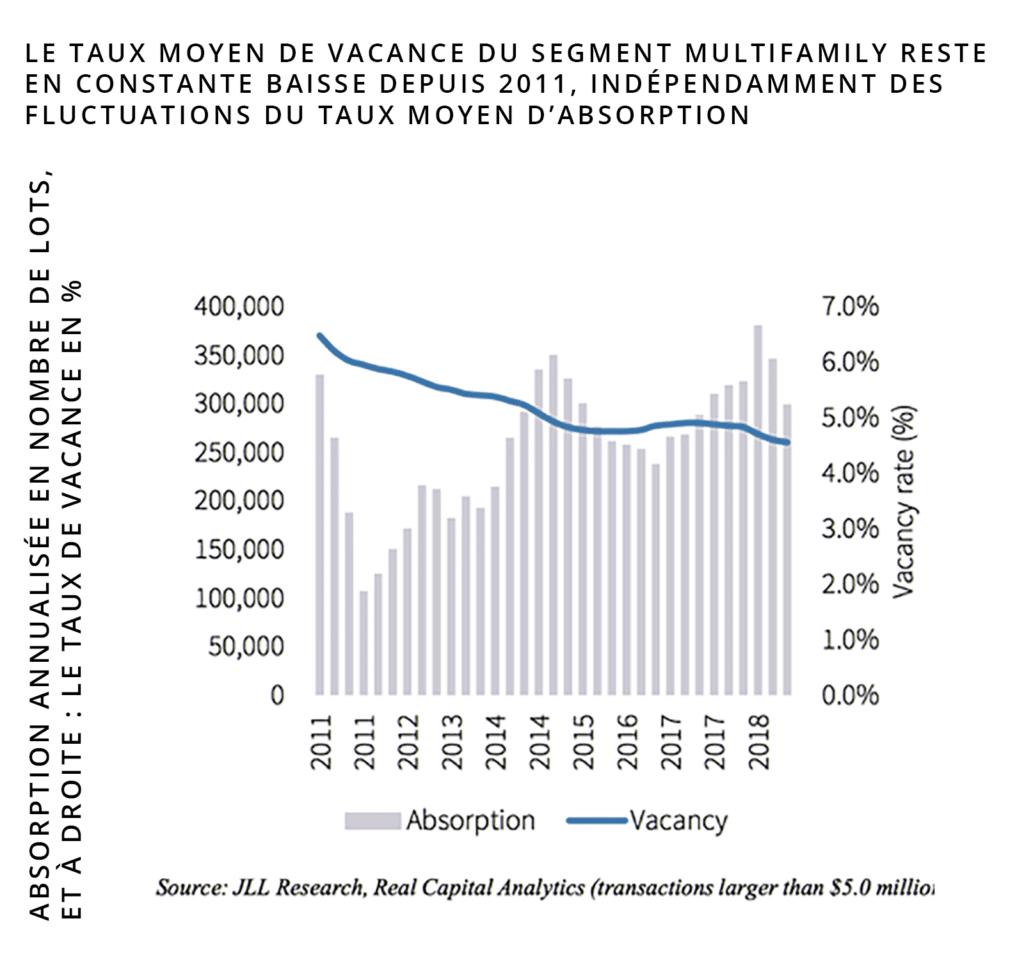

97% of the real estate under management is occupied

Naturally, this is the segment that offers the greatest rental demand, especially for affordable housing that is in line with the income of these populations. As a result, the majority of the communities, buildings and neighborhoods in which we work have occupancy rates close to 100%. Our managed real estate portfolio is nearly 97% occupied year-round.

Investing in this segment of the market not only helps to revitalize an area and offer workers the opportunity to work in a region with many opportunities, but above all it offers great security to real estate investors. Regardless of the global economic situation, these people will always need to live close to their work, schools and universities where they send their children to school, with rents in line with their income.

Davie: an example of responding to local demand

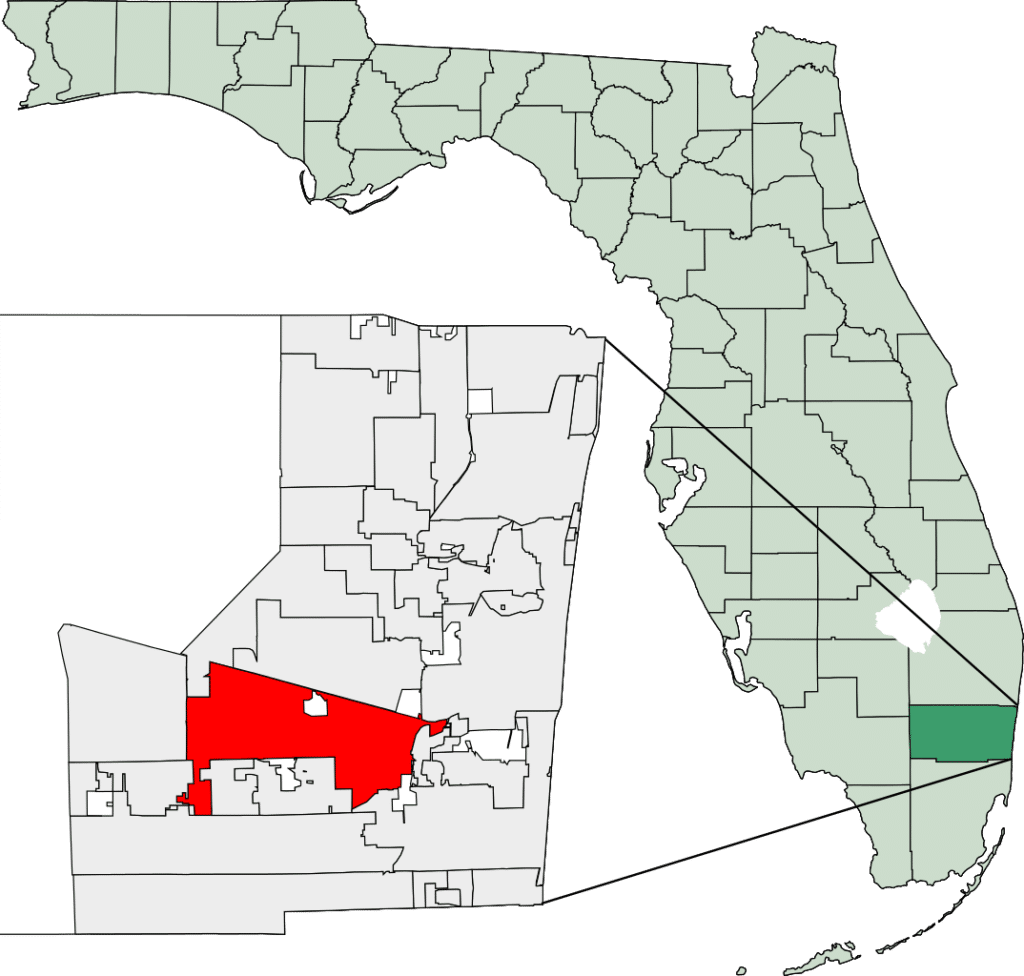

The town of Davie is located about ten kilometers from the city of Fort Lauderdale, capital of Broward County. It is a city that is undergoing a real urban renewal thanks to the investments it is receiving. A few years ago, savvy investors and developers understood its incredible potential by analyzing its fundamentals.

They listened to the local demand and responded with development projects that were in perfect harmony with the town's needs. The result? Outstanding partnerships with the Town of Davie, successful investments, double-digit annual property price growth, soaring rents and record occupancy rates. Mayor Judy Paul called these investments " a true renaissance that everyone was waiting for in Davie. ".

What is this local demand that has been listened to?

The Davie region is a central area that benefits from both the strong economic economic dynamism of the city of Miami, but also from the enormous transformation that has been around Fort Lauderdale in recent years.

More than $1 billion is being invested in the development of the new Davie Hospital and more than 30,000 new jobs are being created in the region each year as a result of the new high-speed train connecting Miami to Orlando with stops in Fort Lauderdale and West Palm Beach.

Another important point is that the town of Davie (with a population of nearly 100,000) and its surrounding area are home to nearly 80,000 students on the surrounding university campuses.

This nationally and internationally recognized university zone is firmly established around the town of Davie, but really lacks the infrastructure and student housing to support the dynamism of the zone. Students from campuses in the area cannot afford to live in Davie, despite its close proximity to the universities. The student housing market in Davie is therefore in a phase of high demand.

But as recently as a year ago, everything was still to be done in Davie. In 2018, the city was still in immediate demand for more than 4,000 affordable housing units, with an occupancy rate of 97%, an ultra-tight market and a very high rate of owner-occupancy compared to the rest of the the rest of the area.

Today, the aging downtown area, unsuited to the unsuitable for the region's activities is being revitalized with an ambitious urban ambitious urban development project for 2020, which will completely transform the transform the face of the city. Offices, shops and, of course, housing are being offices, shops and, of course, housing are being built in perfect harmony with the city's architectural heritage of the city.

The investors who have contributed to the dynamism of this area with its excellent fundamentals, have bet on a rising area with a strong asset potential, with an ever-increasing rental demand, and in constant evolution.

➞ Find our rule #2 for real estate investment

➞ Find our rule #3: strong economic and demographic indicators

➞ Discover our rule #4: a promising and ambitious micro-market

0 Comments